Financial problems can happen to anyone, whether you are a billionaire or living payday to payday. Inconsistent bill payments or even avoiding these obligations carry many consequences that make your finances suffer even more. Namely, any debt you do not pay on time brings additional interest that can accumulate quickly, and that is the problem.

Whether you pay bills, loan installments, or credit card balances, you always have a deadline by which you can do it and avoid additional costs. Unfortunately, many take this condition lightly and are late with payments or do not settle them at all. Each day of delay brings extra charges, which you agreed to when you entered into a contract with the lender or service provider.

Falling behind your obligations can happen if you have a large debt and several credit lines with installments you pay on different dates. When you do not have a well-organized payment schedule or automated payments, you can easily miss those deadlines. An unpleasant surprise in the form of penalties will await you at some point. Luckily, you have several ways to achieve fradrag gjeldsrenter and avoid accumulating high-interest debt.

Pay Bills on Time

Your finances will be fine as long as you take care of them and know your obligations, as well as how much money you have left after settling them. But you can be too relaxed with your debt and use money that should go towards its repayment for something else. But do not think this action will pass without consequences. The debt will still be waiting for you, only now it will be larger.

Even though you may not have enough money this month to, for example, visit the hairdresser, which is something you can delay. But paying your bills on time should be your priority. Logically, this should be the golden rule you should adhere to because paying debts on time means there are no late payments and, therefore, no penalties.

You should avoid late payments not only because of the high-interest rates but also because they can damage your credit score in the long term. The regular payment history makes up more than a third of your credit score, so it is clear that any delay affects its drop.

So, try to organize the payment schedule yourself. It would be best if all deadlines were as close as possible to your payday so that the debts would be settled as soon as possible. An even better option is to set up autopay to deduct a certain amount from your account every month and transfer it to your financial obligations. That is probably the best way to pay your bills before it is too late.

Limit Spending

The most important rule of good financial habits is to spend within your means. That is sometimes difficult to do, given the seeming freedom provided by, for example, credit cards. By hasty financial decisions, you can reach a card limit that you will have a hard time paying off later. If you do this with several credit cards, you are on a sure path to financial doom.

So, first thing first, limit your spending. It might be hard to resist impulse purchases and all those discounts and “amazing deals” that simply tempt you to grab your wallet. But before you do that, think about how it will affect your budget. Do you really need a new TV right now? You may enjoy the high-resolution image, but your budget will suffer.

The situation is similar when you borrow money you do not need. More on the valid reasons getting a loan read on this page. Loans can help you solve some current problems, but if you do not really need them, it is better to hold off until you fix your finances. That is much better than paying installments you do not have to, not to mention how it will save you high-interest rates in case you fall behind on your payments.

Pay More Than a Minimum

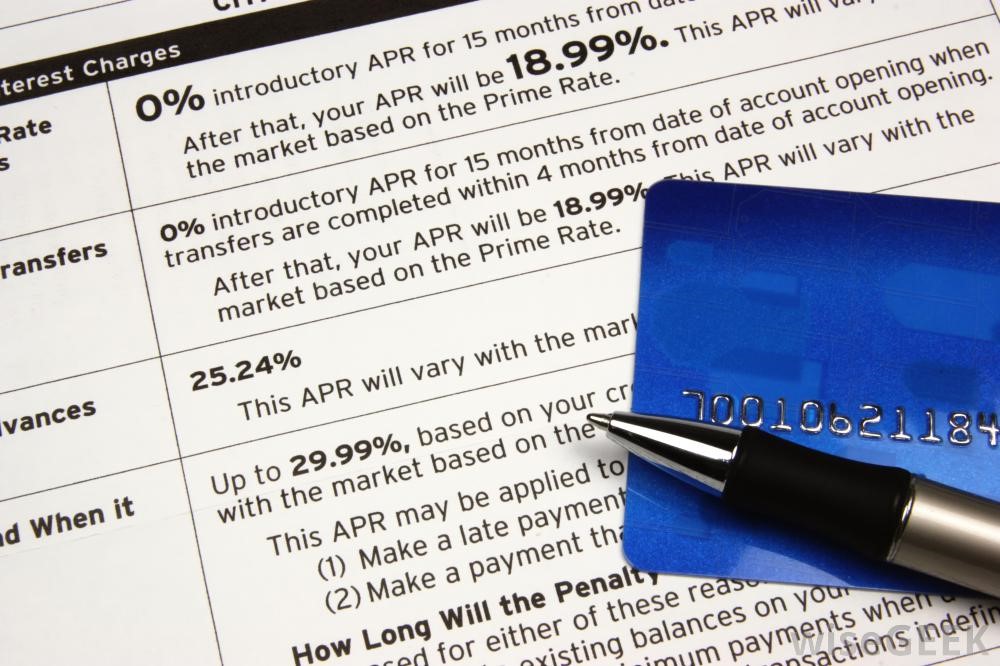

This method can apply to all lines of credit, but it works best with credit cards. Many people use them, and these financial instruments are handy. But they can also be quite costly if misused. You do this by having a high utilization rate or paying only the minimum card balance.

The minimum is the amount that the cardholder determines based on the card limit, your income, and creditworthiness. As long as you pay it, you will maintain good standing with the card issuer and have no problems with your credit score. But the problem arises if there is some balance amount left that you just transfer month by month. One day, it has to be paid in full, increased by significant interest.

To avoid this massive attack on your budget, the best thing you can do is pay more than the minimum. Whenever possible, try to pay off the card balance in full. Prioritize cards that carry a higher APR or those you use more. Keep other cards active by paying only a minimum, but if you really do not need them, it is probably the wisest option to shut down lines of credit you do not use.

As for loans, the installment you are currently paying can be called the minimum. Some lenders may not offer this option, but if they do, it is always a good idea to make extra payments to the principal. That can bring significant savings in the end because you will cut the debt on which you pay interest, and therefore all loan costs will be lower.

Think of Refinancing

Before you completely lose track of your financial obligations, you should spot the warning signs that trouble is on the horizon. For example, your salary is low, you already missed some deadlines, and the interest on the loans you pay has increased. Eventually, all those will trim your budget, creating the risk of not paying other bills and accumulating debt.

That is something you want to avoid, especially when your financial situation is not great. So now is probably the right moment to consider refinancing. For example, you can take out a debt consolidation loan to help you eliminate some high-interest debts and pay only one interest instead of several. It is a good option for borrowers who have problematic credit lines with high APRs.

Or you can replace the current loans with more favorable ones, with a low-interest rate or a longer repayment period, depending on whether you want to reduce monthly obligations or get rid of the debt as soon as possible. If they are variable-rate loans, you can switch them to fixed ones, which is especially advantageous when interest rates are falling. In this way, you will make payments predictable and be able to plan your budget accordingly, without delays and high interest on your debts.

On the following source, get more details on refinancing:

https://themortgagereports.com/51755/should-i-refinance-for-quarter-percent-lower-refinance-rates

Have Emergency Fund

Saving money is sometimes easier said than done, but anyone can do that in their own way. Even the smallest saving is better than none. If you have the habit of putting a little money aside every month, you will quickly have an emergency fund that you can rely on when rainy days come. You never know when bad things, like job loss or medical emergency, can happen.

Your emergency fund is like a safety net, and the amount you should have there should be enough for some time, usually three to six months. You can tap into your savings when emergency expenses arise or when a salary is late, but bills are due. That side money will enable you to settle your debts and avoid late payment penalties.

These rules are not set in stone because every situation is different. But if you can apply them, you should do so as it is a sure way to avoid consequences that can leave a bad mark on your financial situation and credit history.