What is Automated Market Maker (AMM)?

Generally speaking, an Automated Market Maker is a protocol that uses smart contracts to automatically offer a price for the exchange of digital assets between two users. It eliminates intermediaries and provides a centralized order book for users. The advantage of using AMM is the reduction of transaction fees and the elimination of risks. The protocol also offers users the opportunity to earn passive income.

AMMs can be used to trade a wide range of assets. These include crypto assets and fiat currencies. The protocols also allow for trading pairs. AMMs also provide traders with an option to set slippage limits, which can provide more control over the transactions. However, there are also risks associated with trading with AMMs. Some of these risks include slippage and impermanent losses. These risks can be mitigated through better models.

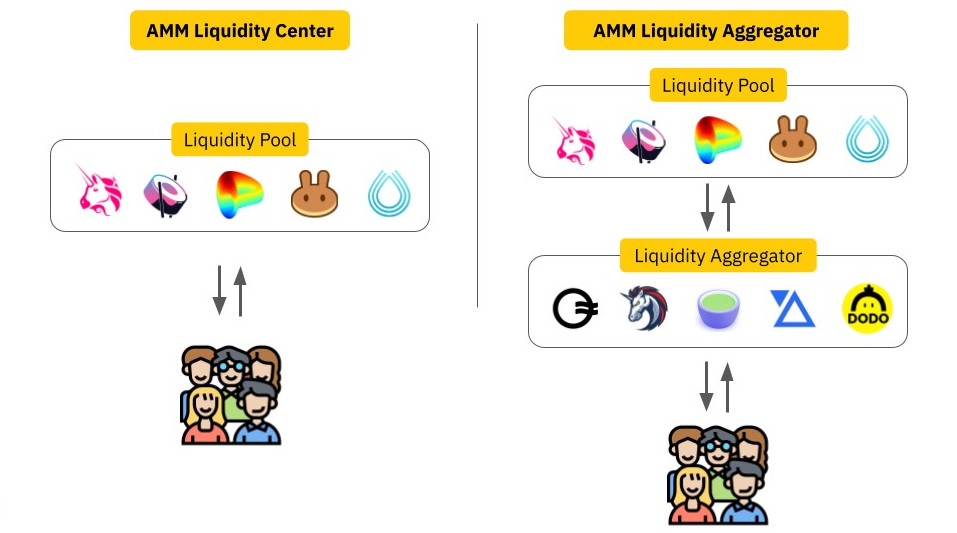

AMMs operate in a liquidity pool on a DEX. The pool is a shared pot of assets that users can trade for other cryptocurrencies. In order to participate in the pool, participants must first deposit a certain amount of Ether. In exchange, they earn fees for trading in the pool. Liquidity providers also risk losing money when the price of their assets moves too far in one direction.

AMMs also use algorithms to determine the price of assets within the pool. These prices follow a curve determined by a mathematical formula. The price is also regulated by arbitrators, who decide how much to charge for each asset. This formula can vary from protocol to protocol. In general, the value of each token within the pool must remain the same, even if the price of the other asset increases.

Users can also participate in an AMM by providing liquidity to the pool. They can do so by depositing tokens into the pool or staking tokens to earn interest income. This provides an incentive for participants to offer capital to the pool. AMMs also require participants to have a high level of capital efficiency. This requires the participants to take active participation in the trades and ensure that there is adequate liquidity oversight.

Another advantage of AMMs is the elimination of intermediaries and order books. This saves money for both merchants and investors. AMMs also use algorithms to execute trades. This reduces the time spent on transactions and increases efficiency. It also provides users with 100% uptime.

Automated Market Makers are a fundamental protocol used by DEXs. However, they pose many risks and threats to the exchanges and traders. Some of these threats include slippage, impermanent losses, and interest-yielding deposit plans. It is important for traders to understand these risks before investing in assets traded by what is AMM. The best way to avoid these risks is to use an AMM that offers a high level of security and development.

The future of automated market makers will continue to play a significant role in the development of DeFi. In order to increase the liquidity and stability of the market, better scaling solutions will be needed. As of now, the volume of AMMs is not very high compared to the largest centralized exchanges. However, some companies are stepping up to offer new solutions in the AMM space.