Benefits of having a Net 30 account

Suppose you are a small business that is expanding. In that case, you will want to take advantage of every opportunity, and you should carefully consider what a Net 30 account can mean for your company. Net 30 business credit means that you will be paid in full within 30 days of sending your invoice to your client.

Net represents when a payment is due when it comes to business. Net 30 means that the client has 30 calendar days to pay the invoice. This is essentially a type of trade credit that you, as a seller, extend to your clients, giving them a 30-day window to pay the total amount of the invoice.

The net 30 accounts are beneficial in various industries, particularly those that rely on a steady supply of materials. Such a business has a payment extension plan by purchasing supplies from Net 30 vendors, which can help them stay ahead and avoid going into debt before turning a profit.

Why use net accounts

Improve your business’s cash flow: you can plan your cash flow, the sales rhythm, and the upcoming payments. With a Net 30 cost, you have up to 30 days to prepare your cash inflow.

Simplify the accounting process: instead of processing payments immediately, with a Net 30 credit, you have 30 days to do so, and you can accurately process each sale/purchase.

Procure materials and plan your expected profits: If your company manufactures and sells products, a Net 30 payment account allows you to better plan your desired profits. You must pay for materials in advance, and the Net 30 payment will be the proceeds from the sale.

Develop business credit: The Net 30 account can assist your company in developing business credit without the need to pay interest. You won’t be able to accumulate debt if you make payments on time, reflecting positively on your business credit.

Pros and cons of net account:

Pros:

- An inducement for customers to purchase your goods and services.

- Create trust and loyalty between you and your customers.

- Doing certain future business

- You can include a discount for early payment.

- Both the vendor and the buyer can benefit from flexible repayment terms.

Cons:

- Small businesses cannot afford to wait 30 days.

- Late payments can cause accounting issues.

- You run the risk of losing money and never being paid.

Is a Net 30 Account Right for Your business?

Suppose you are a small business that is expanding. In that case, you will want to take advantage of every opportunity, and you should carefully consider what a Net 30 account means for your company. Net 30 business credit means that you will be paid in full within 30 days of sending your invoice to your client.

This is often a good thing because it allows you to entice customers with the promise of a 30-day payment extension. The next 30 vendors give new businesses a little leeway regarding when payments are due, allowing them to plan their funds accordingly.

Business Types That Accept Net 30 Accounts

Net 30 (and, in some cases, Net 60 and 90) trade credit is widely used in small to medium-sized businesses as a form of small business financing; the 30-day payment extension allows clients to plan their budget and pay their terms. Let’s look at which types of businesses with B2B services typically have Net 30 accounts.

- Companies that provide B2B services and products

- Medical clinics

- Construction firms

- Manufacturing companies

- Suppliers to restaurants

Platforms that are best for a net 30 accounts:

Summa Office supplies:

Summa Office Supplies sells office supplies such as pens, pencils, folders, paper, tape, and anything else an office might need. You’ll want to use their Net 30 vendor credit as a developing business, but you will have to prepay your purchases in the first six months. You will be eligible for Net 30 vendor credit after establishing a positive payment credit history. Summa Office Supplies reports to Equifax and Dun & Bradstreet credit bureaus.

To apply, go to their website, create an account with your company information, and place a prepaid order. After six months of continuous pre-orders and increasing demands, you will be eligible for the “pay later” option. If you apply for Net 30 vendor credit, you will be approved within 24 hours and can use the 30-day payment extension.

Crown Office supplies:

As the name implies, Crown Office Supplies is a supplier of office supplies such as paper, pens, folders, and envelopes. This company reports to all major credit bureaus and works with both new and established businesses. All new companies can use the base credit line, which grows as the business grows and makes regular payments.

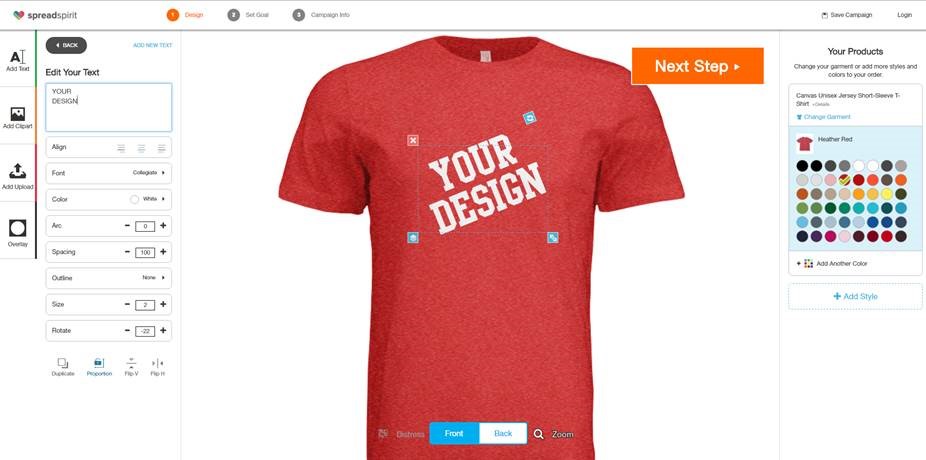

The business T-shirt club:

The Business T-Shirt Club offers bulk discounts on blank work apparel such as T-shirts, sweatshirts, hats, sportswear, corporate apparel, outerwear, masks, and other items. They work with both new and established businesses and file reports with Equifax, Credit Safe, Dunn & Bradstreet, and Ansonia & Cortera.

This business offers its customers custom printing and embroidery and print-on-demand and discount programming. All members must pay a $69.99 annual membership fee to access the advanced services.

Quill

Quill is a company that sells office supplies and cleaning supplies and safety, laboratory, and healthcare supplies.

Quill requires all new businesses with no business credit history to purchase a minimum of $100 per month for 90 days before applying for Net 30 vendor credit. All new applicants must be approved for Net 30 credit, which takes a day or two.

Creative Analytics:

This business provides digital marketing services such as website and social media plans and a wide range of essential products such as desk and office accessories, fitness items, professional beauty tools, kitchen tools, and more. Equifax and Credit Safe are the business credit bureaus to which they report.

All businesses that apply for the Net 30 vendor credit must pay a yearly fee of $79 to Creative Analytics. In addition, all new applicants must spend a minimum of $100.

Conclusion:

Net accounts can also help you manage your company’s finances more easily. If your account and payment history are reported to a business credit bureau, a net-30 account can help your business establish its business credit report and build business credit. There are various websites who provide various services and facilities to help new and established businesses. Before selecting a website ensure you know everything regarding terms and conditions.